Streamlining invoices is critical to any successful business. Ensuring a business’ invoicing system is both efficient and accurate will aid in ensuring revenue is both timely and consistent. Accurate invoicing reduces the inefficient use of resources, amount of queries, and payment delays.

Here are several tips to help your company improve its invoicing system:

#1 Get an Invoicing System

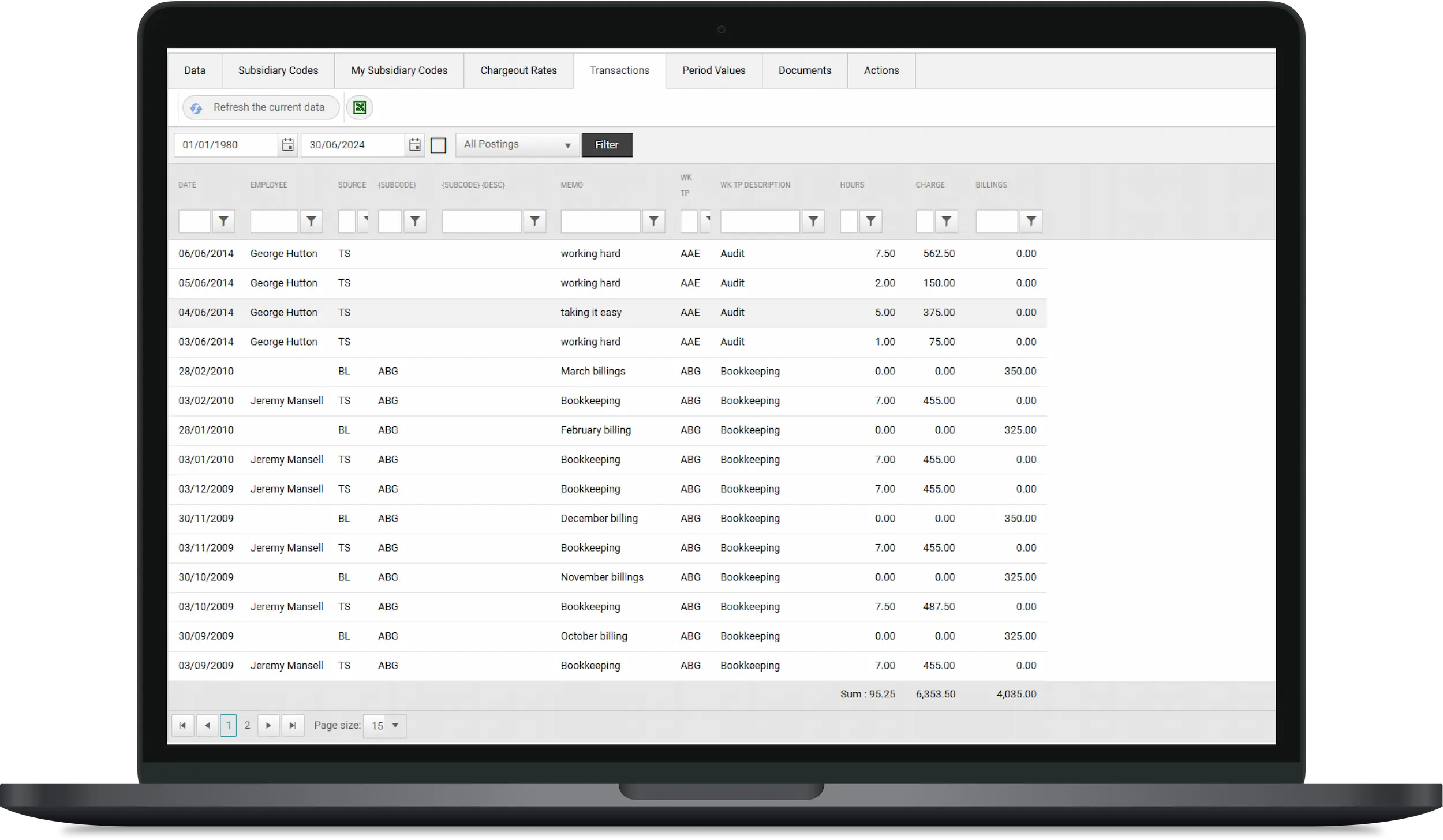

In today’s current age of technology, the era for paper invoicing is almost extinct. Instead invoicing systems are becoming more integrated into time tracking software. Such systems are designed to help businesses keep track of the hours spent on site or on projects. This assists with accurate invoicing.

TallyPro is a software that incorporates invoicing with time tracking saving businesses money. Try a Free Trial and experience the power in online invoicing.

#2 Brand your invoices

Implement the following ideas to help avoid your invoice being lost in your client’s myriad of paperwork:

- Include your business logo on the invoice header

- Make use of your brand colours

- Ensure your invoice formatting is both professional and consistent

#3 Keep things clear and consistent

Since invoices are often read quickly, consistency and clarity in both invoice format and data are paramount. Banking details, payment options, pricing, etc…, all need to be clearly laid out and easily read. Effective invoices have all relevant information consistently laid out and legible. This includes using a font that is both easy to read and well sized. Finally, invoices should remain in a single pay layout.

#4 Use accurate data

With the aid of time tracking software like TallyPro, your business is able to know what projects or tasks have been completed and how they were completed. Included is the amount of time required for the completion of each task or project. This will help your invoices reflect accurate data and pricing for services rendered. Accurate data means accurate invoices which in turn provide accurate payment.

#5 Several payment options

Your company invoice should specify the different methods of payment clients can select from based on their current needs. Some examples are as follows:

- Cash payments

- Monthly repayments via stop orders or electronic transfers

- Online payments via debit card or credit card

- Cheque payments

Whichever payment options listed, an invoice needs to include the required website address as well as relevant banking details. Don’t forget to specify how you want your clients to reference their payments.

#6 Be clear on financial policies

Ensure your clients easily understand your business financial policies. This includes terms and conditions, policies on late payments, refund and return policies, and liabilities. Your invoice should communicate these policies clearly to clients.

Clearly stipulate any financial policies, discounts, etc…, on each invoice. Clients should be able to easily understand these policies.

#7 Track your invoices

Keep your financial statements and tax payments on track by tracking your invoices correctly. Each invoice should have its own sequential tracking number. This will ensure that the filing of invoices occurs correctly and following up with invoice queries is more streamlined.

Besides numbering your invoices, you can track your invoices by ensuring those that have been paid are clearly marked whereas those invoices with outstanding payments remain in a file for further follow up and confirmation.

#8 Send your invoices on time

Invoices should be sent out immediately after work has been completed or service delivered. Timely invoices result in timely payments. Besides ensuring a steady income stream, prompt invoicing maintains company professionalism as well as reduces invoice queries.

Sending invoices electronically as well as via standard mail will help get your invoices to clients quickly and efficiently. Electronic invoicing can also help get invoices to clients who have recently had a change of address.

#9 Follow up on invoices

Once invoices have been issued, the work is not over. Following up on invoices is critical to ensuring you receive payment for services rendered. Check the company bank accounts to see if the payment reflects. If not, follow up with a courteous email which can include assistance to any queries the client may have.

When following up on outstanding payments, request clients send proof of payment once payment has been made.

Commercial Software Limited

Commercial Software Limited